Towards the end of 2022, as global

economic crisis concerns grew, there was a general perception that 2023 would

be a challenging year for technology startups. Worldwide, there was a significant

decline in investments, especially in deals exceeding $100 million.

In Turkey, in addition to global

uncertainties, the country had suffered deep psychological and economic wounds

due to the earthquakes on February 6th. These earthquakes claimed the lives of

thousands and directly affected nearly 15 million people, bringing the

country's life to a standstill. During this period, investments in technology

startups significantly slowed down. Efforts were focused on healing the wounds

caused by the earthquakes.

Just three months later, in May,

Turkey held its general elections. Foreign investors, in particular, awaited

the election results, which further slowed down investments in the country.

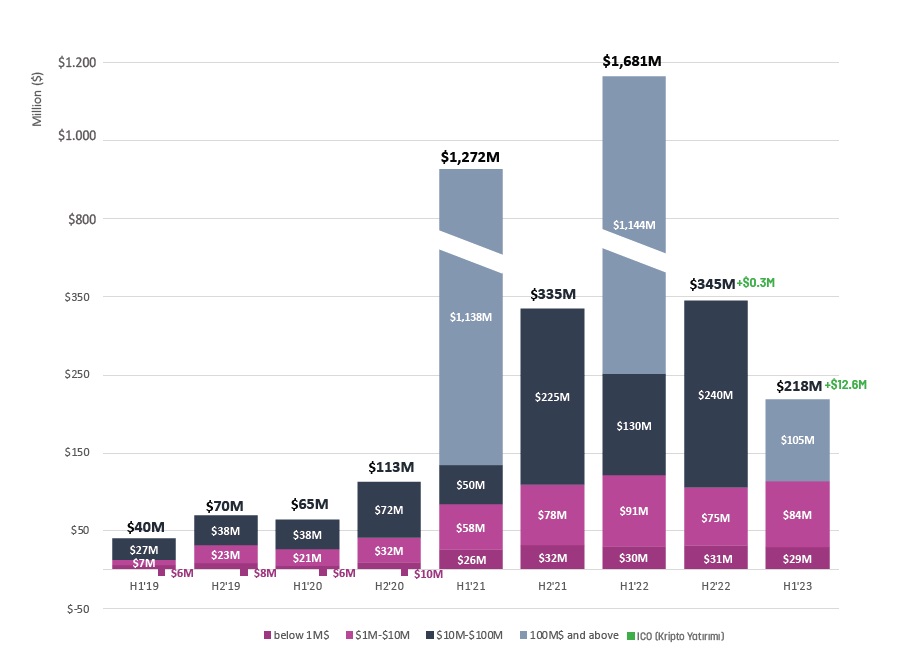

In the first half of 2023, 162 tech startups received a total of $218 million in investments. The median investment value was $350,000.

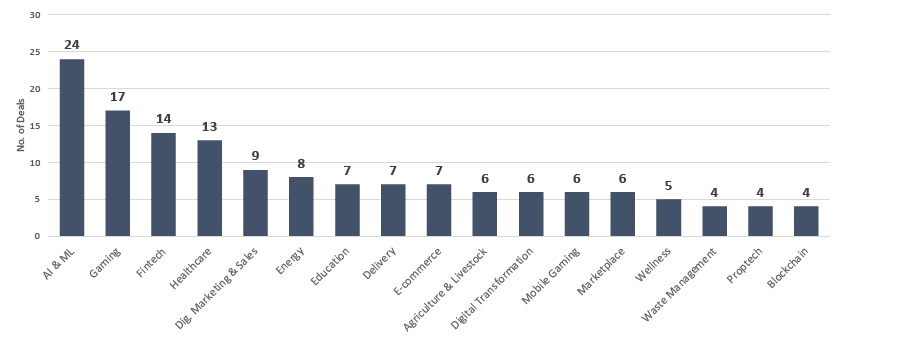

The distribution of investment

amounts by sectors is as follows: ·

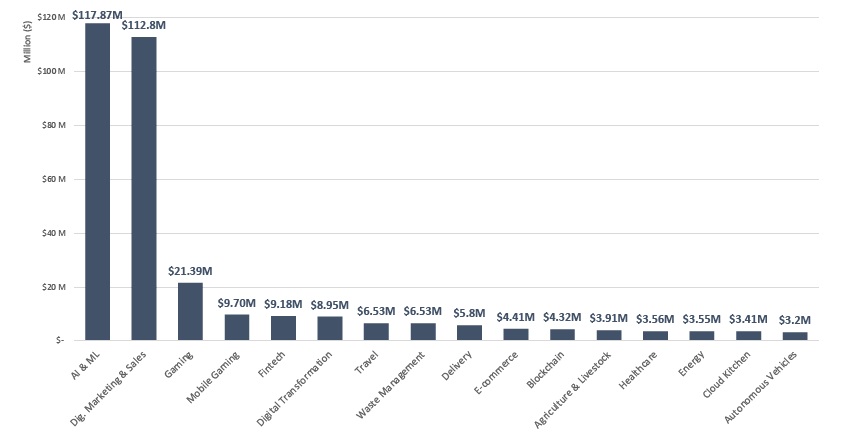

$118 million for the Artificial Intelligence & Machine

Learning sector ·

$113 million for the Digital Marketing & Sales sector ·

$21 million for the Gaming sector Additionally, there were a total of

24 startups in the Artificial Intelligence & Machine Learning sector, 17 in

the Gaming sector, and 14 in the Finance sector that received investments. In

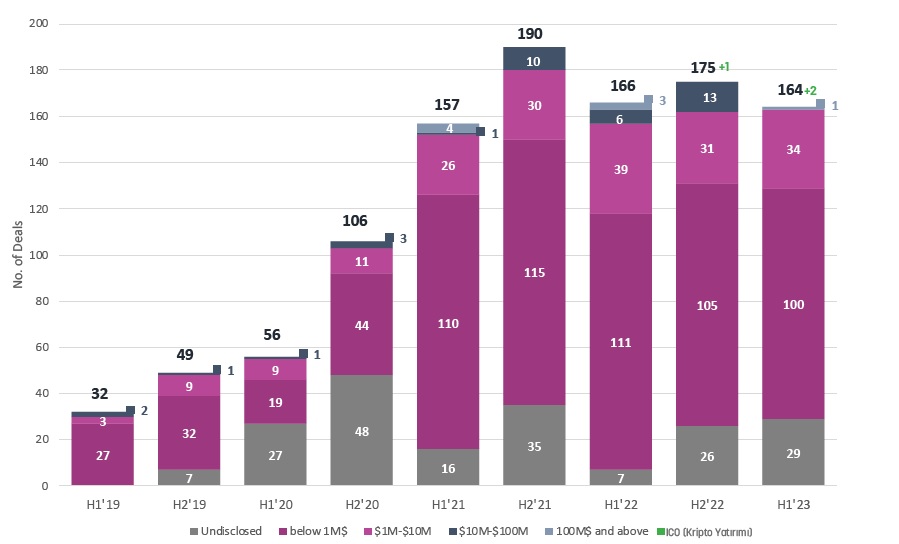

the first half of 2023, a total of 164 investment rounds took place. When

looking at the overall figures, it appears that the investment amount reached

the levels of the first half of 2022. However, a closer look reveals a

different picture. Firstly, there are 29 investment rounds in which the

investment amounts were not disclosed, as indicated in the graph. In these 29

rounds, two had valuations between $10-20 million, while the rest had

valuations below $5 million. This suggests that the majority of the investment

amounts were below $1 million. Therefore, assuming that the undisclosed

investment rounds were also below $1 million, it can be observed that out of

the 164 investments made in the first half of 2023, 129 of them (78%) were

below $1 million. In the first half of 2022, 118 out of 166 investments (71%)

were below $1 million. The increase in the number of investments below $1

million in the past half-year was primarily due to crowdfunding investments. In

2023, there were 32 crowdfunding investments, with 29 of them being below $1

million. Another significant difference when

comparing the 1st half of 2022 to the 1st half of 2023 was the absence of any

investments in the range of $10-100 million in 2023. These investments,

predominantly involving foreign investors, indicate a decline in foreign

interest in the ecosystem for this year. Despite these discouraging numbers, it

should not go unnoticed that there were 34 investments in the range of $1-10

million, marking the second-highest number of investments in this range on a

semi-annual basis in the history of the ecosystem.

While the first half of 2023 paints a

somewhat challenging picture, there is no immediate cause for concern in the

short term. However, concerns arise for the medium and long term, especially

regarding the emission premium tax imposed on startups that receive investments

in Turkey, which might lead these startups to move their headquarters abroad.

Additionally, the migration of talents to foreign countries to work for foreign

companies remotely could have adverse effects on the quality of startups.

Receiving salaries in foreign currency might also become increasingly

challenging for startups. For 2023, taking into account factors

such as the global decrease in technology startup investments, it can be stated

that the ecosystem had a favourable period in terms of investments. In the

first half of 2023, the total investment amount was $218 million, with $105

million of this amount coming from a type of investment known as Convertible

Note, received by the company named Insider. This period is noteworthy as it

marks the lowest investment amount achieved in the past two years. The scarcity

of investments in the range of $10-100 million is particularly noticeable and

suggests a decrease in foreign interest in the ecosystem. However, it's

important to highlight those 34 investments in the range of $1-10 million took

place in the first half of 2023, marking the second-highest number of

investments in this range on a semi-annual basis in the ecosystem's history. When looking at the cities where

startups are based in Turkey, Istanbul remains the city that received the

highest amount of investments. 126 startups in Istanbul received approximately

$190 million in investments. Among these Istanbul-based startups, 21 received

investments through crowdfunding. In Ankara, 14 startups received a total of

$9.2 million in investments. Notably, startups in Ankara that received over $1

million in investments include Frantic Games ($2.4 million), Hipporello, which

operates from the United States but also has operations in Ankara ($1.8

million), and Beam Teknoloji ($1.5 million). In Izmir, 10 startups received a

total of $12.5 million in investments. The majority of this $12.5 million, $6.5

million, belongs to HotelRunner, a travel startup headquartered in the UK but

operating from Izmir. Other notable startups include Paxie Games ($3 million)

and FileOrbis ($2 million). Kocaeli received a $3.3 million

investment, with the majority of this investment, $3 million, going to Saha Robotik.

Additionally, the city of Erzurum, appearing on the list for the first time,

received an investment of approximately 7.5 million Turkish Liras for For

Physician, a platform guiding general practitioners located in Erzurum.

In 2023, the sectors receiving the

most investments are consistent with previous years. These sectors include

Artificial Intelligence & Machine Learning, Gaming, Finance, and Health.

Additionally, there has been a notable increase in investments in the Digital

Marketing & Sales sector, particularly in Software as a Service (SaaS)

startups.

In the first half of 2023,

startups operating in the field of Artificial Intelligence and Machine Learning

received approximately $118 million in investments, while startups in the

Digital Marketing and Sales sector received around $113 million in investments.

It's worth noting that Insider, which received a $105 million investment, is

active in both of these sectors. Investments in the Gaming sector were lower

compared to 2021 and 2022. However, one of the noteworthy sectors in 2023 is

Digital Transformation. Six startups in the digital transformation and

documentation digitization sector received a total of $8.95 million in

investments. Another standout sector is Waste Management, with four startups in

this field receiving a total of $6.5 million in investments.

Resource: Startupcentrum.com/EN_S1'2023 Turkish Startup Ecosystem Investment Report

Photo by Daria Nepriakhina 🇺🇦 on Unsplash