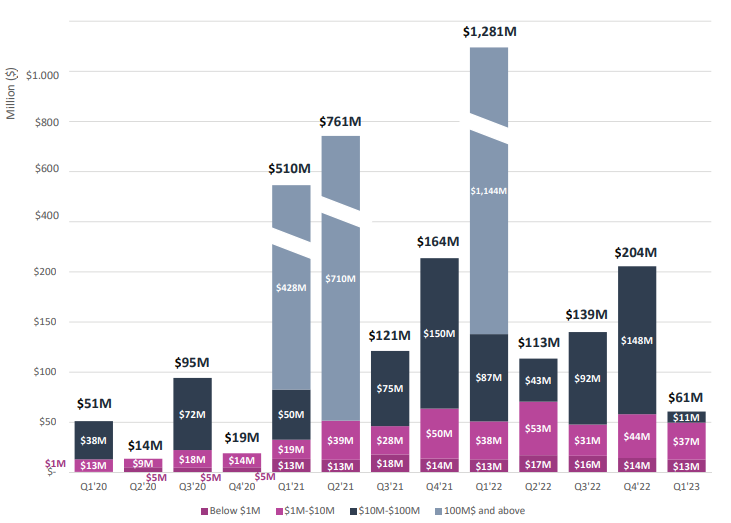

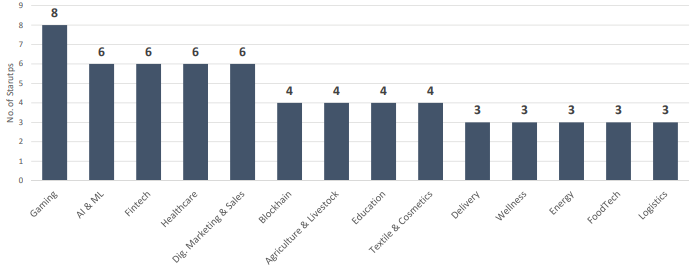

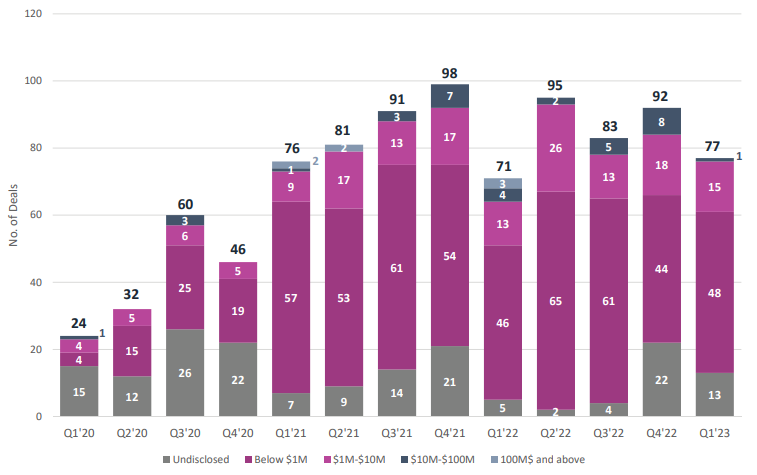

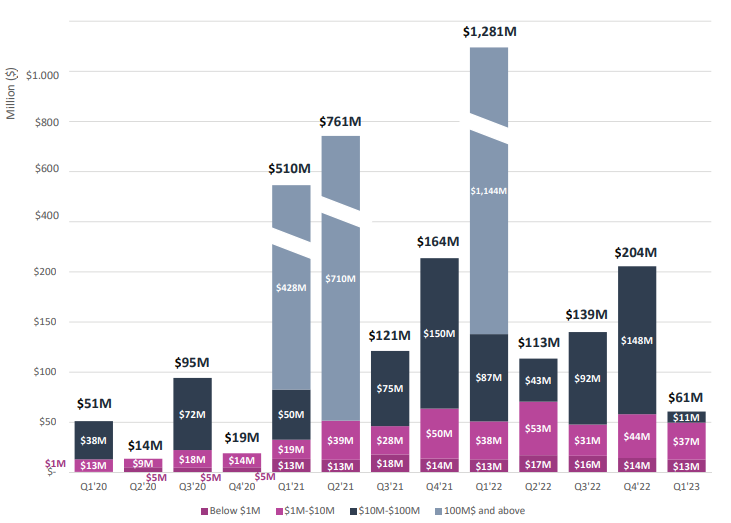

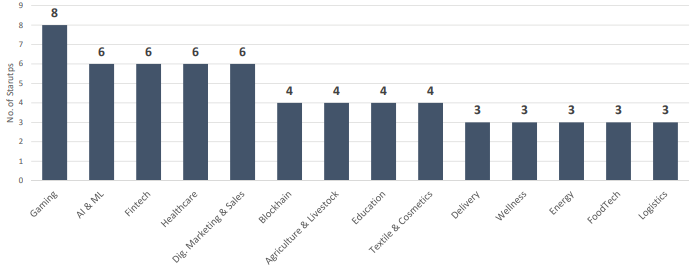

In 2020, a total of $178 million was invested in the Turkish entrepreneurial ecosystem. By 2021, the total investment amount exceeded $1.5 billion, driven by a few start-ups that received mega investments. This trend continued in 2022, with a total investment of $1.6 billion. However, there were concerns about how the global economic and political climate would affect tech start-ups. In the first quarter of 2023, 77 start-ups received $61 million in investments. While the number of funded start-ups remained similar to previous years, the total investment amount was lower, mainly due to a lack of high-value investments. The tech start-ups received investments in various sectors, including blockchain ($15.2 million), gaming ($9.7 million), and travel ($6.5 million). There were also investments made in eight gaming start-ups, six finance start-ups, six AI & machine learning start-ups, six health start-ups, and six digital marketing & sales start-ups. Economic uncertainties and global crises negatively affected tech start-ups' access to investments toward the end of 2022, leading to a significant decrease in high-value investments. This trend appears to continue in 2023.

After the rapid rise in previous

years, investments have slightly slowed down in this quarter. There has been a

significant decrease in investments of over $10 million, with only one

investment taking place in the first quarter of the year. However, the number

of investments below $1 million and between $1 million and $10 million is

almost at the same level as the first quarter of the previous year. This

indicates that there is still interest in tech start-ups. The decline in

high-value investments may pose challenges for tech start-ups seeking funding.

We mentioned earlier that start-ups

in Türkiye received a total investment of $61 million in the first quarter of

2023. This is the quarter with the least amount of investment since 2021. From

2021 onwards, multiple investments in the range of $10 million to $100 million

were made in each quarter, raising questions about the sustainability of these

investments in the ecosystem in 2023. Particularly, the reduced interest from

foreign investors has affected high-value investments as well. In summary,

while the number of investments in 2023 is similar to previous years, the same

cannot be said for the investment amount. The decline in high-value investments

may pose challenges for tech start-ups seeking funding. However, the continuation

of low-value investments can provide opportunities for entrepreneurs to pursue

sustainable growth strategies.

Out of the 77 technology start-ups

that received investments in the first quarter of the year, 60 were based in Türkiye.

These start-ups collectively obtained investments amounting to $39.4 million.

The investment details of 31 out of these 60 start-ups were verified through

the Turkish Trade Registry Gazette. The information for the remaining 29 start-ups,

including crowdfunding investments, was partially confirmed through the Trade

Registry Gazette. These data demonstrate the continued interest in technology start-ups

in Türkiye.

Analyzing the distribution of investment-receiving start-ups across cities, Istanbul remains in the first place. The 59 start-ups in Istanbul received approximately $50 million in investments. In Ankara, 8 start-ups obtained a total investment of $2 million. In Izmir, 6 start-ups secured a combined investment of $9.8 million. Moreover, cities such as Kayseri, Kocaeli, Konya, and Sakarya consistently have a few start-ups receiving investments each year. Additionally, Erzurum, which is making its first appearance on the list this year, received investment from For Physician, a consulting platform catering to general practitioners, with an approximate valuation of 7.5 million Turkish liras.

Foreign-based Start-ups:

17 start-ups conducted operations

in Türkiye but had their headquarters located abroad, receiving a total

investment of $21.2 million. Among these 17 start-ups, 6 registered the

relocation of their headquarters abroad in 2023. Out of the start-ups with

foreign headquarters, 10 are based in Delaware (USA), 3 in London (UK), 3 in

Tallinn (Estonia), and 1 in Düsseldorf (Germany). These data indicate that Türkiye

is an attractive market for technology start-ups and that foreign start-ups

also prefer Türkiye as their destination.

The sectors that received the

highest investments in 2023 remained largely unchanged compared to the previous

year. The gaming, artificial intelligence and machine learning, finance, and

healthcare sectors once again attracted the most investments. In 2022, there

was a rising trend of interest in blockchain start-ups in Türkiye, and this

interest seems to continue in 2023. Four blockchain start-ups received a total

investment of $15.2 million. Out of these four start-ups, two were gaming start-ups,

while the other two were focused on building the blockchain ecosystem with

their products. The travel sector followed the gaming sector in terms of

investment.

Although the first quarter of

2023 was a somewhat challenging period for technology start-ups in Türkiye, the

continuation of low-value investments and the support for domestic start-ups

can be considered positive signs. Investors need to recognize the potential of

low-value investments and support start-ups that have the potential for

significant success in the future.

Resource: Startupcentrum.com/EN_Q1'2023

Turkish Startup Ecosystem Investment Report